View the dynamic report here.

Key takeaways

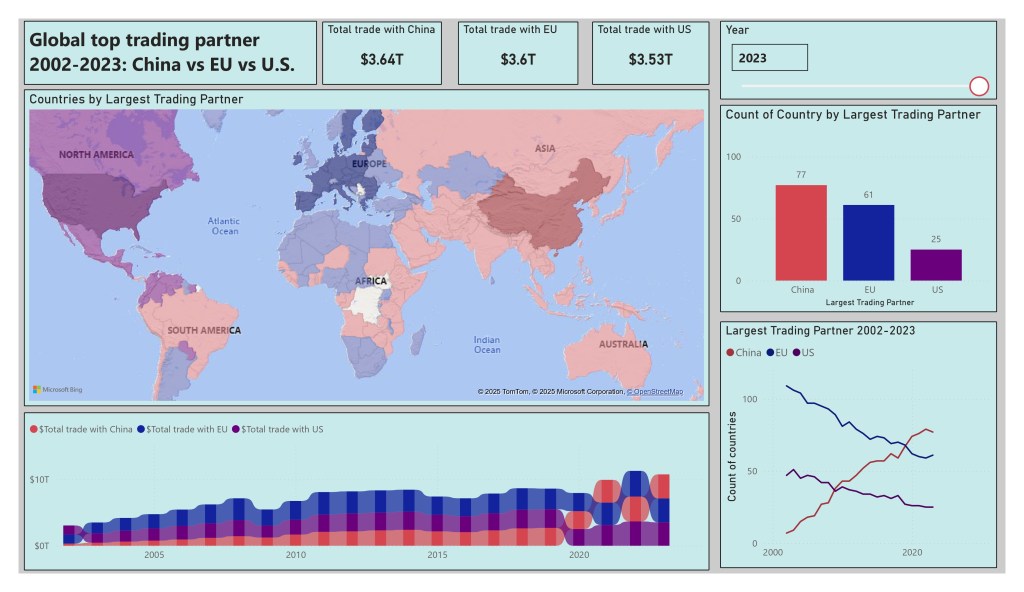

- As of 2023, China is the largest trading partner with the rest of the world compared to the European Union and the United States

- Total trade, sans trade with each other and intra-EU trade, increased for all three top trading powers

- China’s trade with the rest of the world increased by more than 1,000% between 2002 and 2023 ($323 bn to $3.64 trillion), where as EU and U.S. trade increased by approx. 160% during the same period.

- By number of countries with each as its top trading partner, China overtook the U.S. in 2009 and the EU in 2019. By total trade value, China overtook the U.S. in 2020 and competes with the EU between 2021-2023.

Introduction

Many articles and maps show how China overtook the United States as the world’s top trading partner in dollar terms in the last 20 years. Comparatively fewer comparisons take the European Union into account. As a bloc, the European Union account for 17% of global trade in 20241, valuing around 5 trillion dollars. With heightening global tensions and calls within the EU for greater strategic autonomy, EU could emerge as a significant player in the new era of international relations and trade. Therefore, it is important to account for the European Union when analyzing how the international trade system has changed over time.

Methods

Annual trade data for the EU2, United States, and China are extracted from Eurostat, U.S. Census Bureau, and the Havard Growth Lab respectively. Due to different data entry standards, time spans, and geographical extent, the data are first loaded in to Excel for initial cleaning before being further cleaned, transformed, and merged in Power Query. Trade between China, the EU, and the U.S. is excluded, as is trade between EU countries so as to focus only on how the three powers stack up against each other in the competition for the rest of the world’s trade. The result is a long table with each row representing one country or territory in a given year between 2002 and 2023 and three columns with values of the total trade volume (import + export) that country had with the European Union, United States, and China.

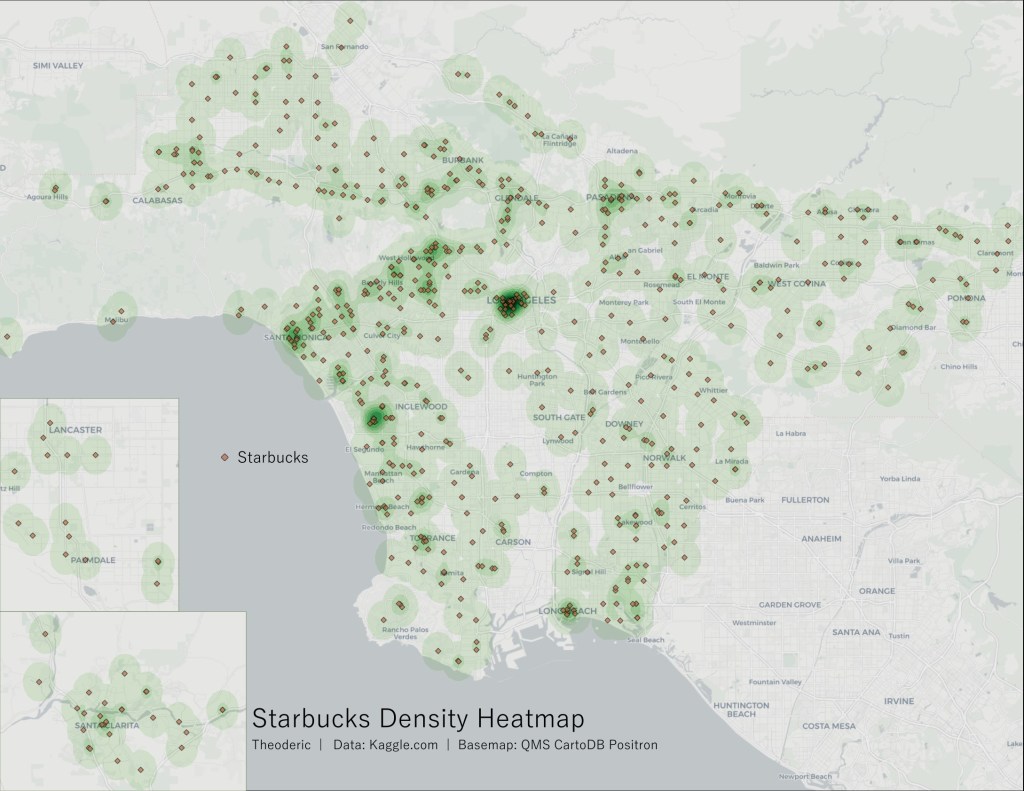

Figure 1: GIF showing how the top global trade partners changed between 2002 and 2023

Findings

As expected, China is the world’s leading trade partner by both total dollar value and the number of countries which has it as the largest trade partner compared to the EU and the United States. In 2023, China led the pack with $3.64 trillion in total trade and was the largest trading partner of 77 countries. The EU followed in second with $3.6 trillion and 61 countries. The U.S. came in last at $3.53 trillion and 25 countries.

Figure 2: Snapshot of the global trade situation in 2023

Despite China’s seeming dominance in global trade, the competition remains fierce. A few points to keep in mind:

- Although China overtook the U.S. and the EU by number of countries with which it is the largest trade partner in 2009 and 2019 respectively, it has only managed to overtake the U.S. by total trade value in 2020 and is still competing for the top spot with the EU as of 2023.

- The total trade value of the three trading powers are very close, with only 3% of difference between China at number one and the U.S. at number three.

- The U.S. and the EU, when combined, still outweighs China in international trade. This highlights the importance of the transatlantic alliance in checking China.

Regional spotlights

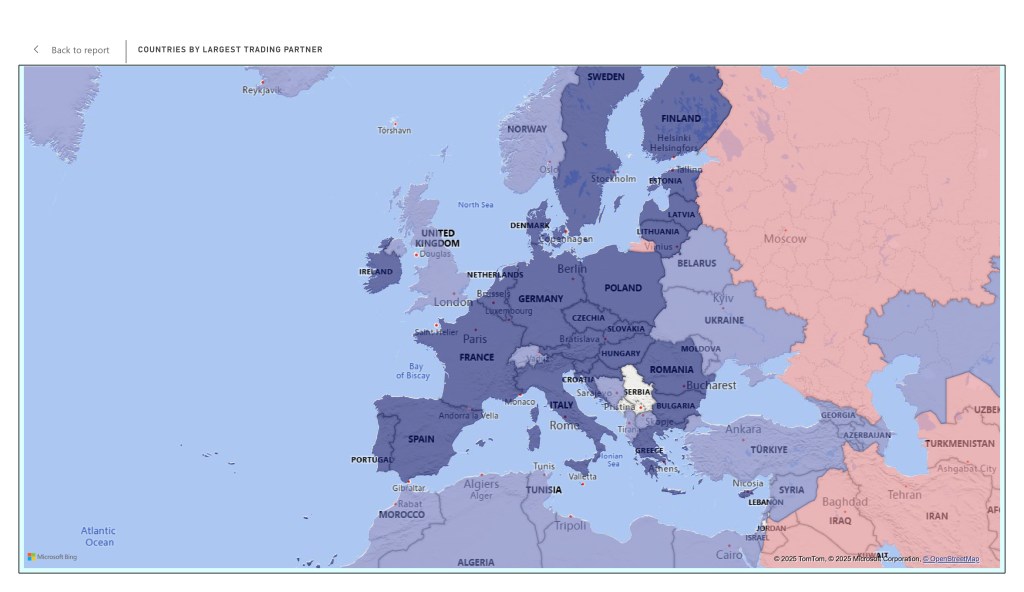

Unsurprisingly, each of the three top trading powers are strongest in their respective neighborhoods.

Figure 3: From left to right: Trade in Asia-Pacific, Europe and the Mediterranean, and North and Central America are dominated by China, the EU, and the U.S. respectively.

However, some areas are still contested between China, the EU, and the U.S. Africa is split between the EU–which is strongest in the northern and southern edges of the continent–and China, which is strongest in East Africa and has gradually grown in influence in Central and West Africa. Meanwhile, South America is contested by all three, with countries on the northern end of the continent (Venezuela, Colombia, Ecuador) trading more with the U.S. and the major South American economies of Brazil and Chile trading the most with China. The EU has managed to retain its top trading position in Argentina and Guyana.

Figure 4: Africa and South America by top trading partner, 2023

Conclusion

Despite the historical dominance of the EU and U.S. in global trade, China has rapidly caught up to them by 2023. China is now the world’s leading trade partner, with the highest trade value and the most countries having it as the largest trade partner. The EU remains a significant player across the globe, especially in Africa, the Middle East, and rest of Europe. The U.S., though dominating less countries in terms of trade than the others, remains very close to China and the EU in total trade value. Overall, the competition for global trade is far from settled and will likely heat up as tensions and uncertainty rise in the coming years.

Notes

1This figure is derived by taking the total global trade volume of 2024–33 trillion dollars, and subtracting it by the volume of intra-EU trade at 4 trillion dollars, as we are treating the EU as a single trading bloc. The subsequent figure of 29 trillion dollars is then used to calculate the relative proportion of extra-EU trade, which is around 5 trillion dollars.

2Eurostat retroactively includes all current EU member states (the “EU 27”) and excludes the United Kingdom from its historical trade dataset. As such, for consistency, this project will not reflect the changing EU membership (13 accessions and 1 departure) in the two decades between 2002 and 2023.

References

- Eurostat, 2025, “Extra-EU Trade in Goods by Partner”, https://doi.org/10.2908/EXT_LT_MAINEU

- Macrotrends, 2025, “EUR USD – Historical Annual Data”, https://www.macrotrends.net/2548/euro-dollar-exchange-rate-historical-chart

- Soltani, Ehsan, April 9 2025, “Mapped: How China Overtook the U.S. in Global Trade (2000–2024)”, Edited by Bruno Venditti, Visual Capitalist, https://www.visualcapitalist.com/cp/how-china-overtook-u-s-in-global-trade-dominance-2000-2024/#:~:text=China’s%20Trade%20Surge%20Over%20Time&text=From%202000%20to%202024%2C%20U.S.,overtaking%20the%20U.S.%20in%202012

- U.S. Census Bureau, 2025, “U.S. International Trade by Partner”, https://www.census.gov/foreign-trade/balance/country.xlsx

- The Growth Lab at Harvard University, 2025, “International Trade Data (HS92)”, https://doi.org/10.7910/DVN/T4CHWJ